9 Bedroom HMO Producing £72,000 PA

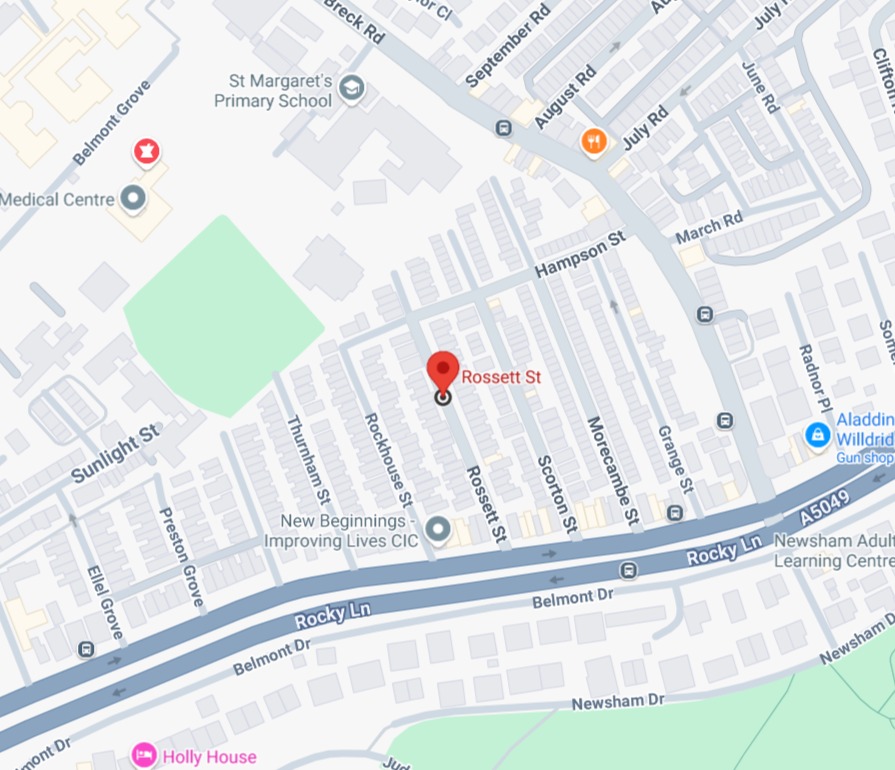

Rossett Street, Liverpool, L6 4AW

Property Information

9 Bedroom HMO Producing £72,000 PA

Rossett Street, Liverpool, L6 4AW

Purchase Price = £570,000

Finder’s Fee = £7,500

CASHFLOW AFTER ALL THE ABOVE COSTS

Managed = £2,779 pcm = £33,348 per annum

Self Managed = £3,499 pcm = £41,988 per annum

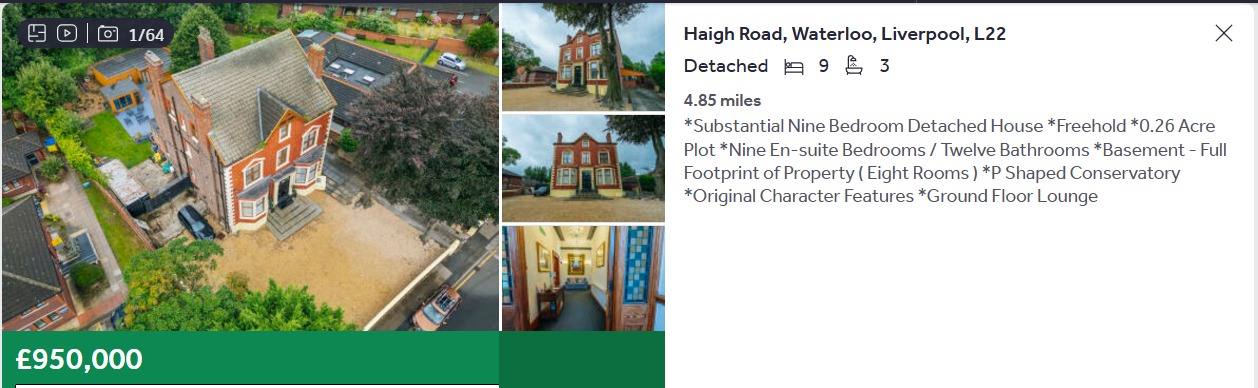

Property Description

For a limited time only, we have managed to secure an income producing nine bedroom HMO within proximity to Liverpool City Centre.

- The property is currently rented and achieving a total of £6,000 pcm = £72,00 per annum

The property briefly comprises:

- 9 Bedrooms HMO

- 7 Bathrooms

- Kitchen

- Rear garden space

The property is conveniently situated in a perfect location within proximity to excellent transport connections, primary schools, local shops, and all the local amenities.

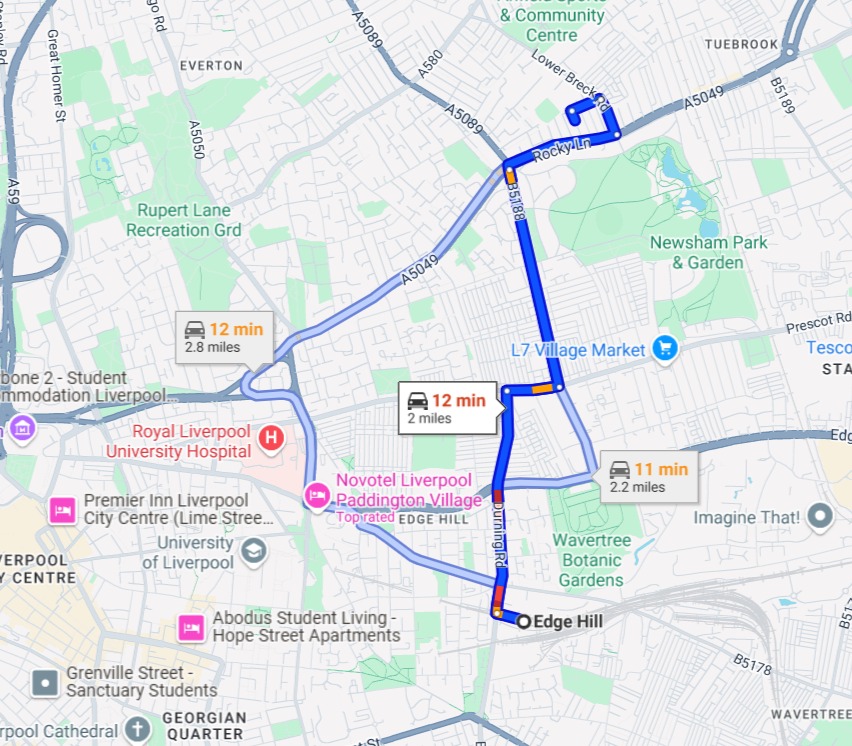

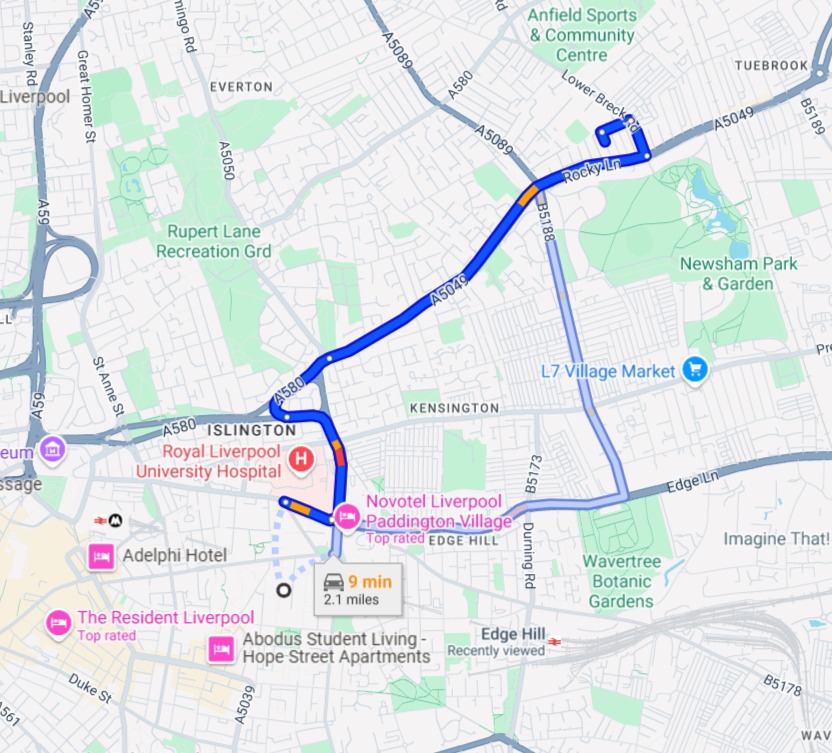

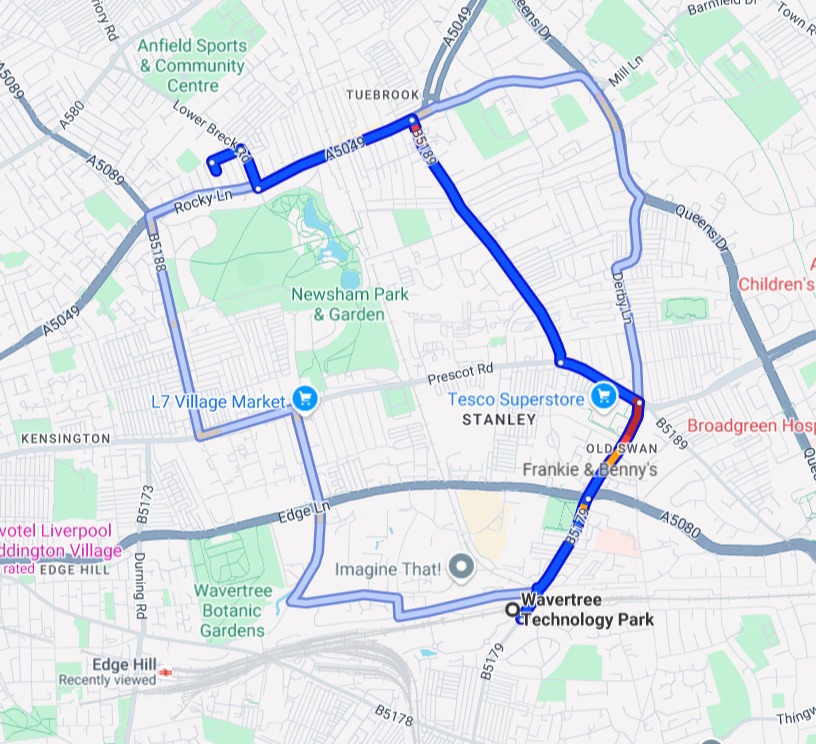

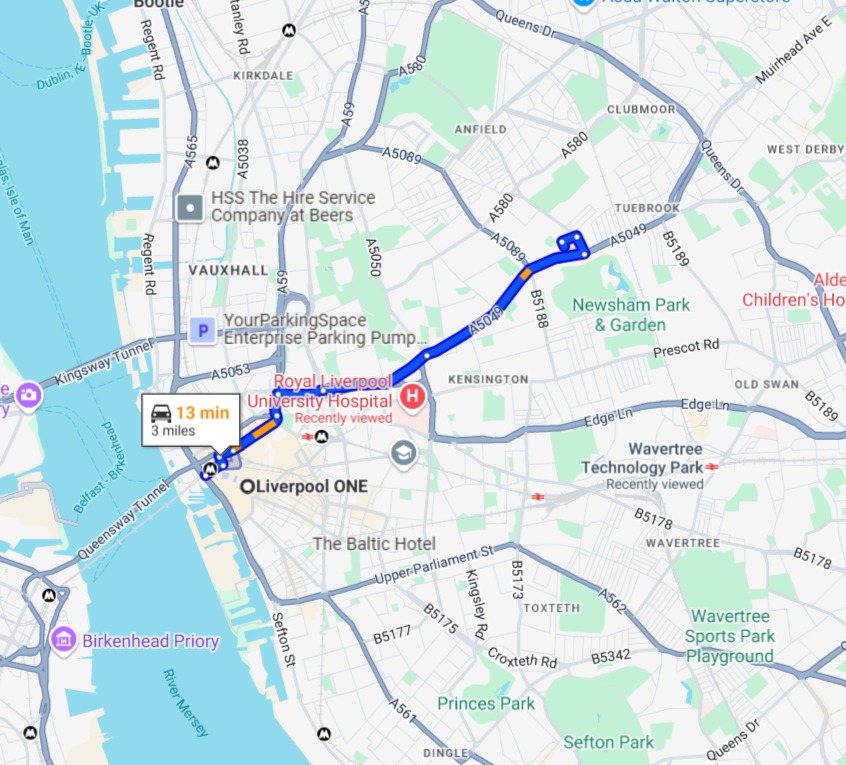

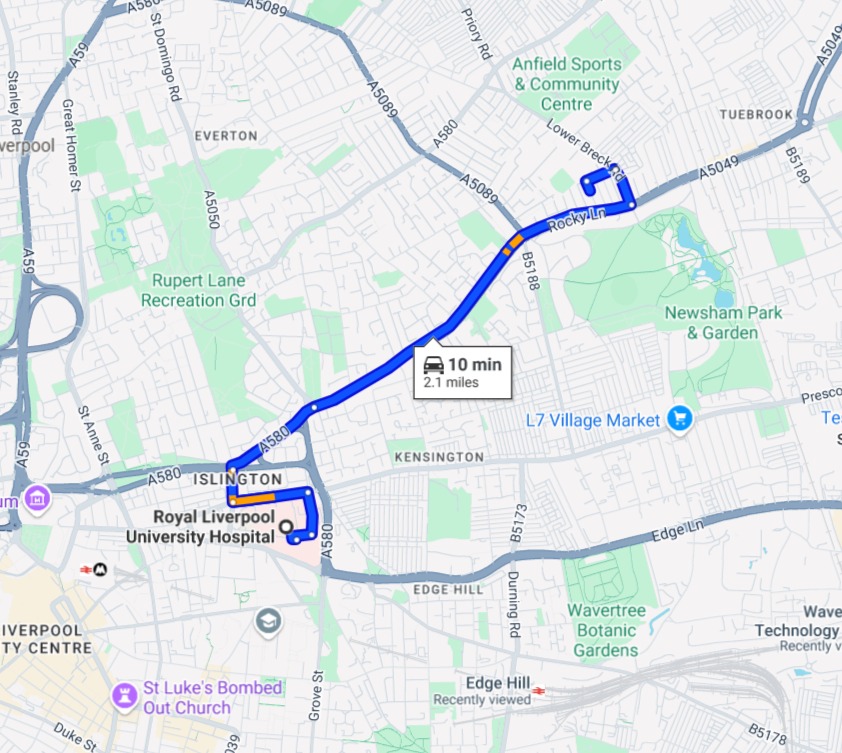

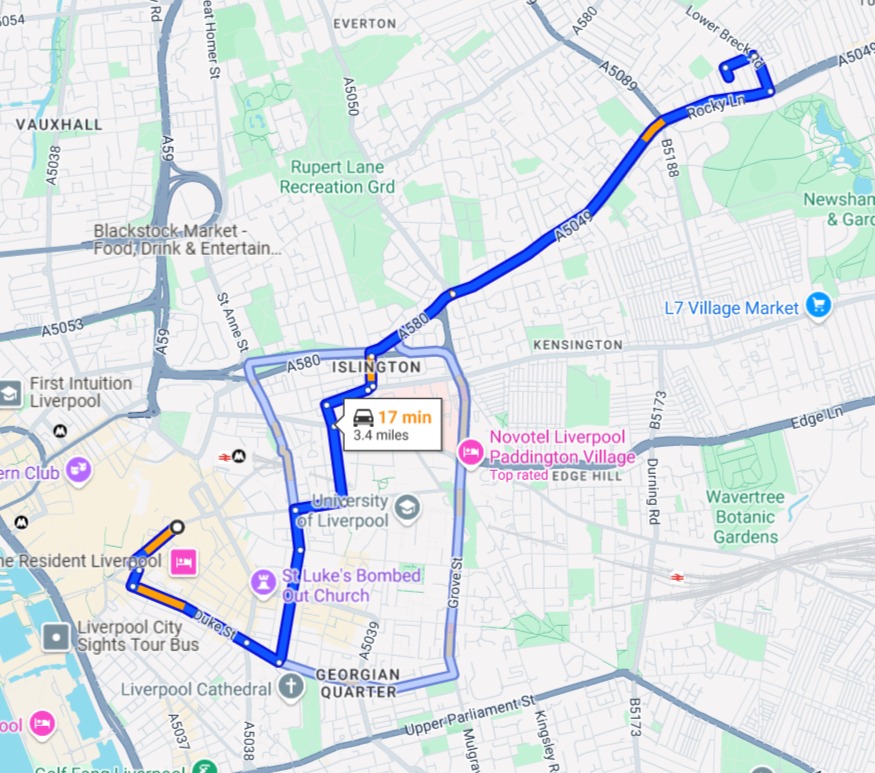

Location

The property is within proximity to:

- 2.0 miles – Edge Hill Station

- 2.5 miles – Wavertree Technology Park Station

- 2.1 miles – University Of Liverpool

- 2.1 miles – Royal Liverpool University Hospital

- 3.0 miles – Liverpool ONE Shopping Centre

- 3.4 miles – Liverpool City Centre

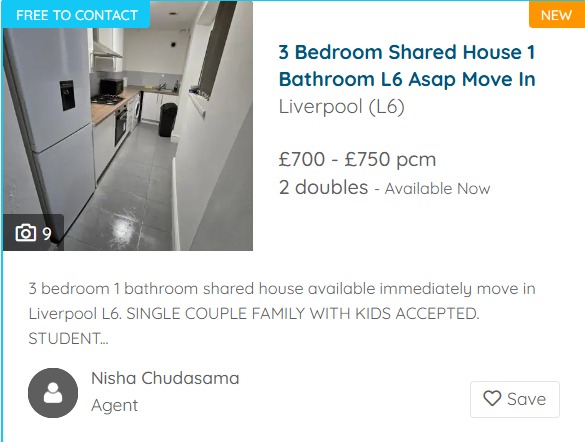

Rental

- The property is currently rented and achieving a total of £6,000 per month

Current Gross Income = £6,000 pcm = £72,000 per annum

The Vision

- To purchase the property for £570,000 and enjoy great cashflow.

- Potential to refinance based on a commercial valuation allowing you to pull out a large majority of your initial capital.

Cashflow Forecast

- Current Rental Income = £6,000 pcm = £72,000 per annum

Cost To Consider

- Mortgage Cost = £1,781 pcm

- Bills and Utilities = £720 pcm

- Management @ 10% + Vat = £720 pcm

CASHFLOW AFTER ALL THE ABOVE COSTS

Managed = £2,779 pcm = £33,348 per annum

Self Managed = £3,499 pcm = £41,988 per annum

Capital Required To Get Involved

- Purchase Price = £570,000

- Deposit @ 25% = £142,500

- Legals = £5,700

- Stamp Duty = £33,100

- Finder’s Fee = £7,500

Total Capital Required = £200,200

The Return On Investment based on an investment of £200,200

Managed = 17%

Self Managed = 21%

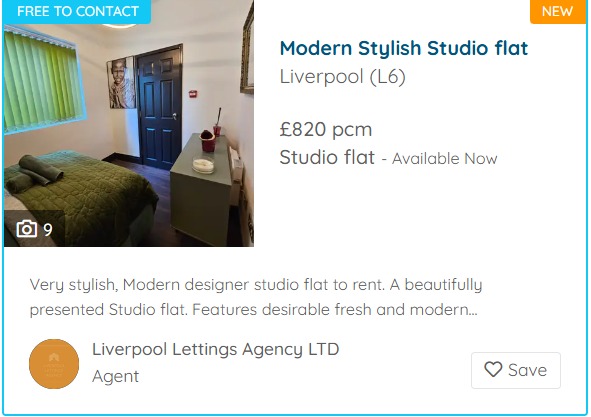

We are in contact with a local letting agency within this location who would be able to manage the property.

Next Steps

- Reserve

- View

- Proceed

Disclaimer - IMPORTANT NOTE TO PURCHASERS:

Investment

£570,000

Purchase Price

£3,499

Cashflow PCM

21%

Return On Investment

£7,500

Finders Fees