Block of 4 Flats - Potential Of £28k PA

Rishton Street, Blackpool, FY1 4DB

Property Information

Block of 4 Flats - Potential Of £28k PA

Rishton Street, Blackpool, FY1 4DB

Purchase Price = £150,000

Finder’s Fee = £8,700

Potential Gross Income = £2,395 pcm = £28,740 per annum

CASHFLOW AFTER ALL THE ABOVE COSTS

Managed = £4,430 pcm = £53,160 per annum

Self Managed = £5,196 pcm = £62,353 per annum

Property Description

For a limited time only, we have managed to secure a readymade block of four apartments within proximity to Blackpool City Centre.

- As standard single let, the property could achieve an average of £2,395 pcm = £28,740 per annum

- As serviced accommodation, the property could achieve an average of £6,384 pcm = £76,608 per annum

The property briefly comprises:

- 4 apartments

The property is conveniently situated in a perfect location within proximity to excellent transport connections, primary schools, local shops, and all the local amenities.

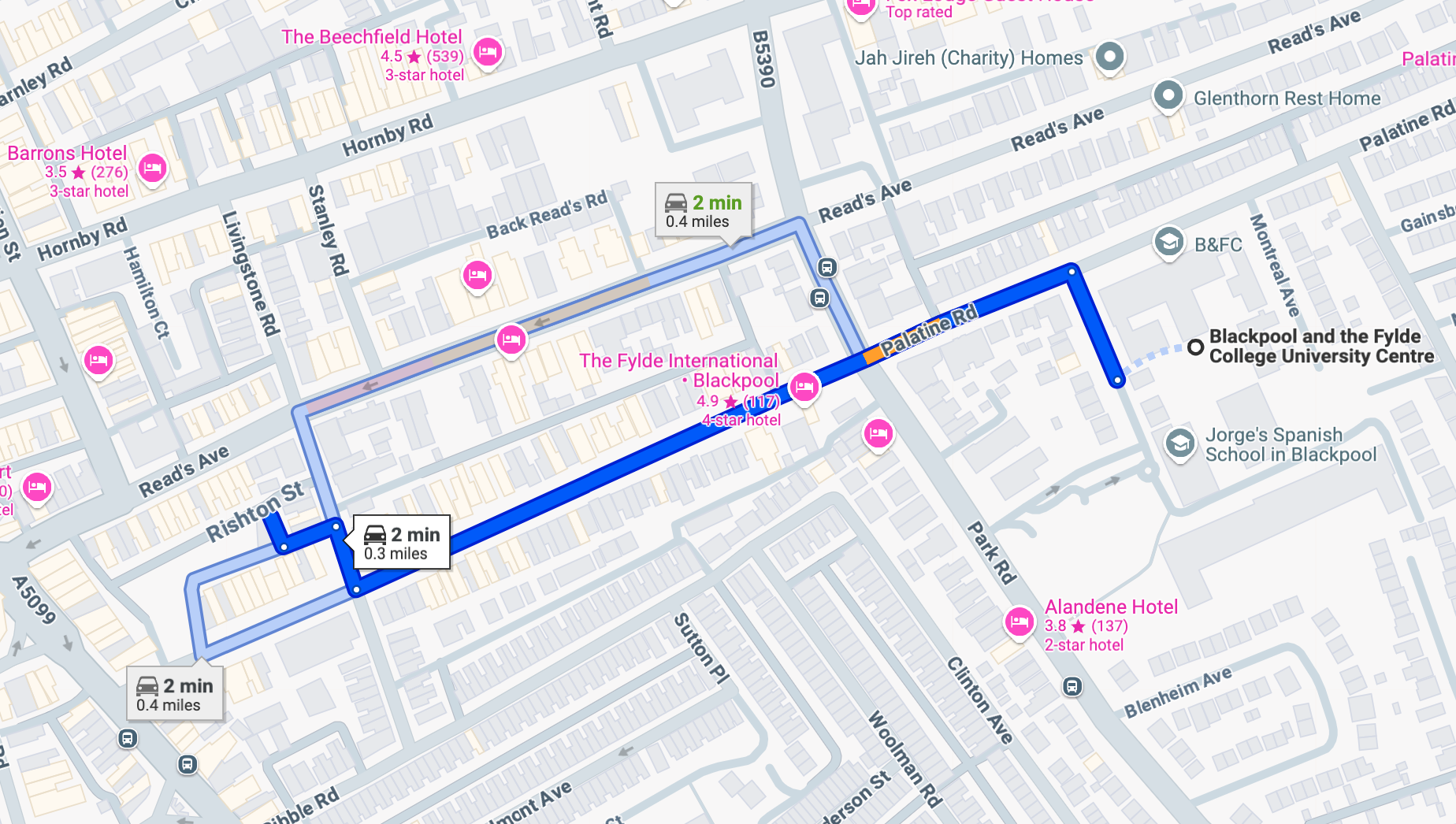

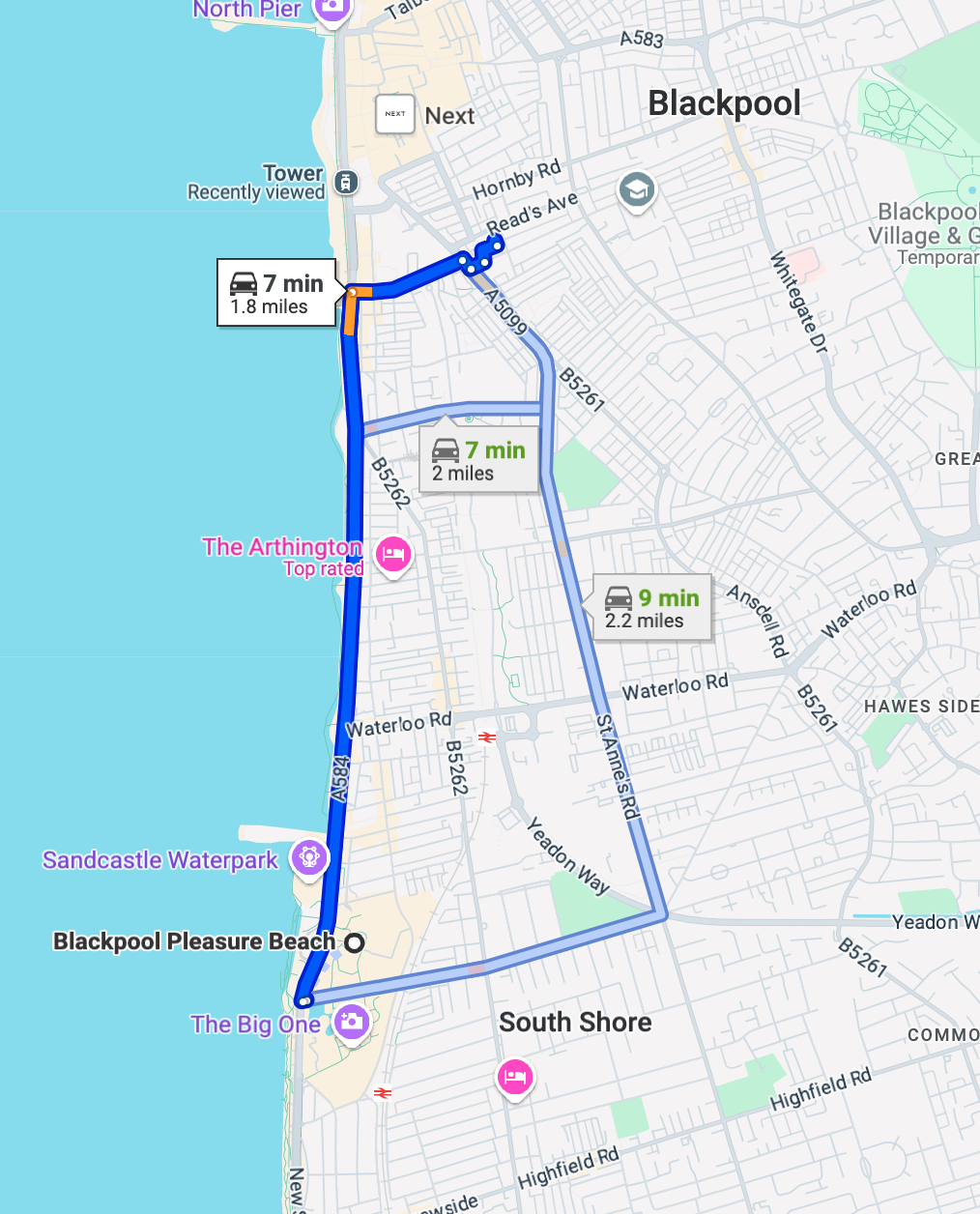

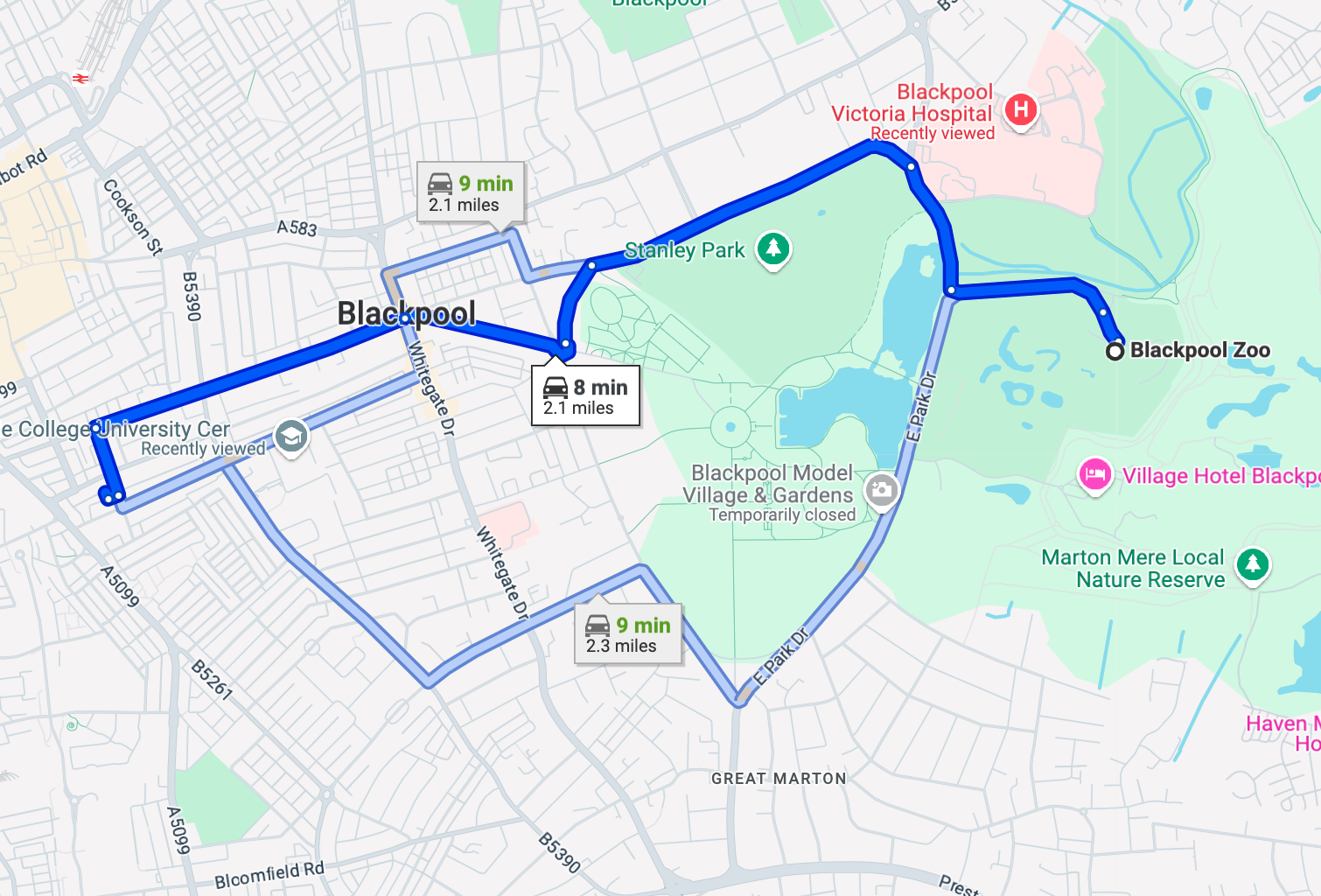

Location

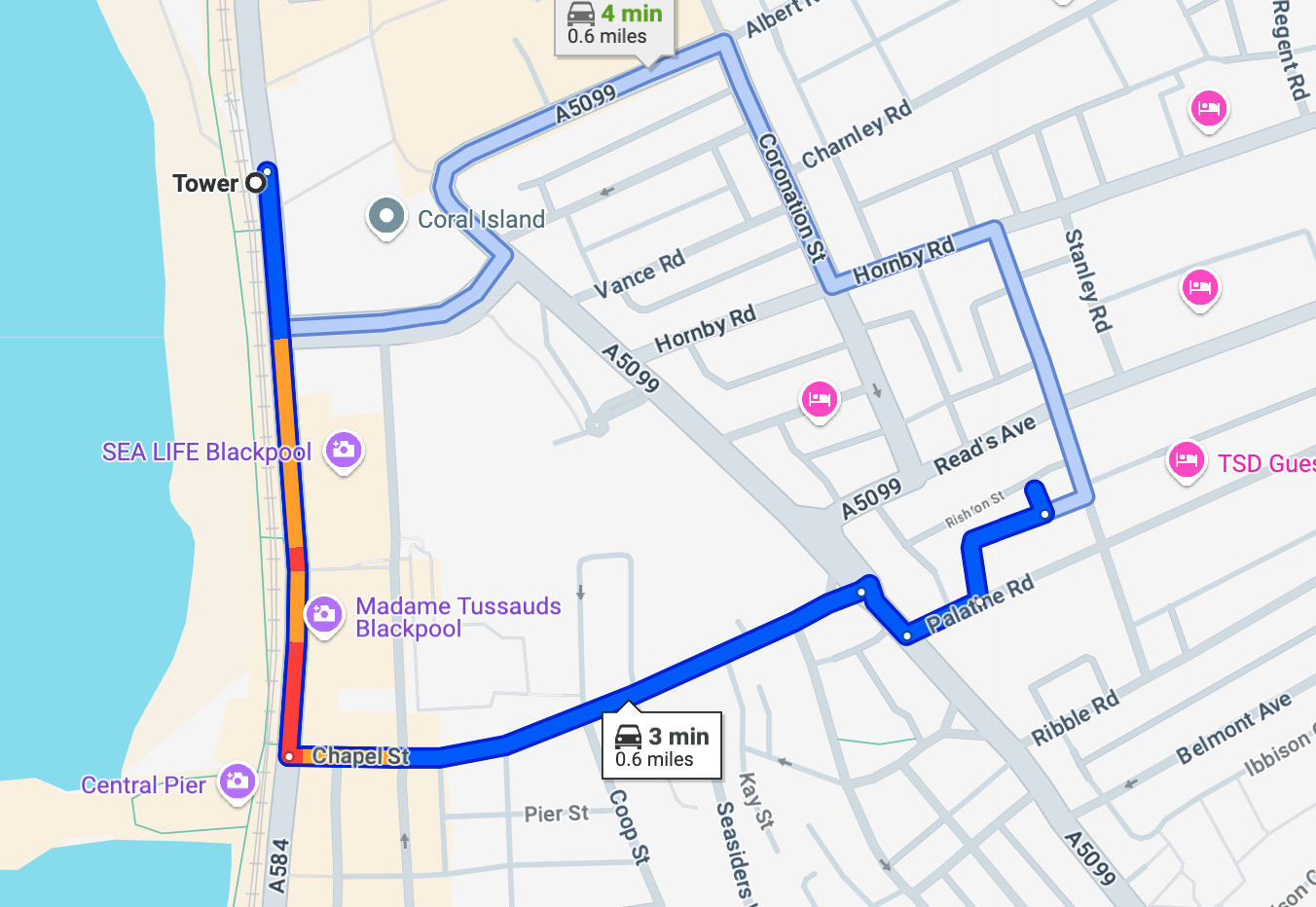

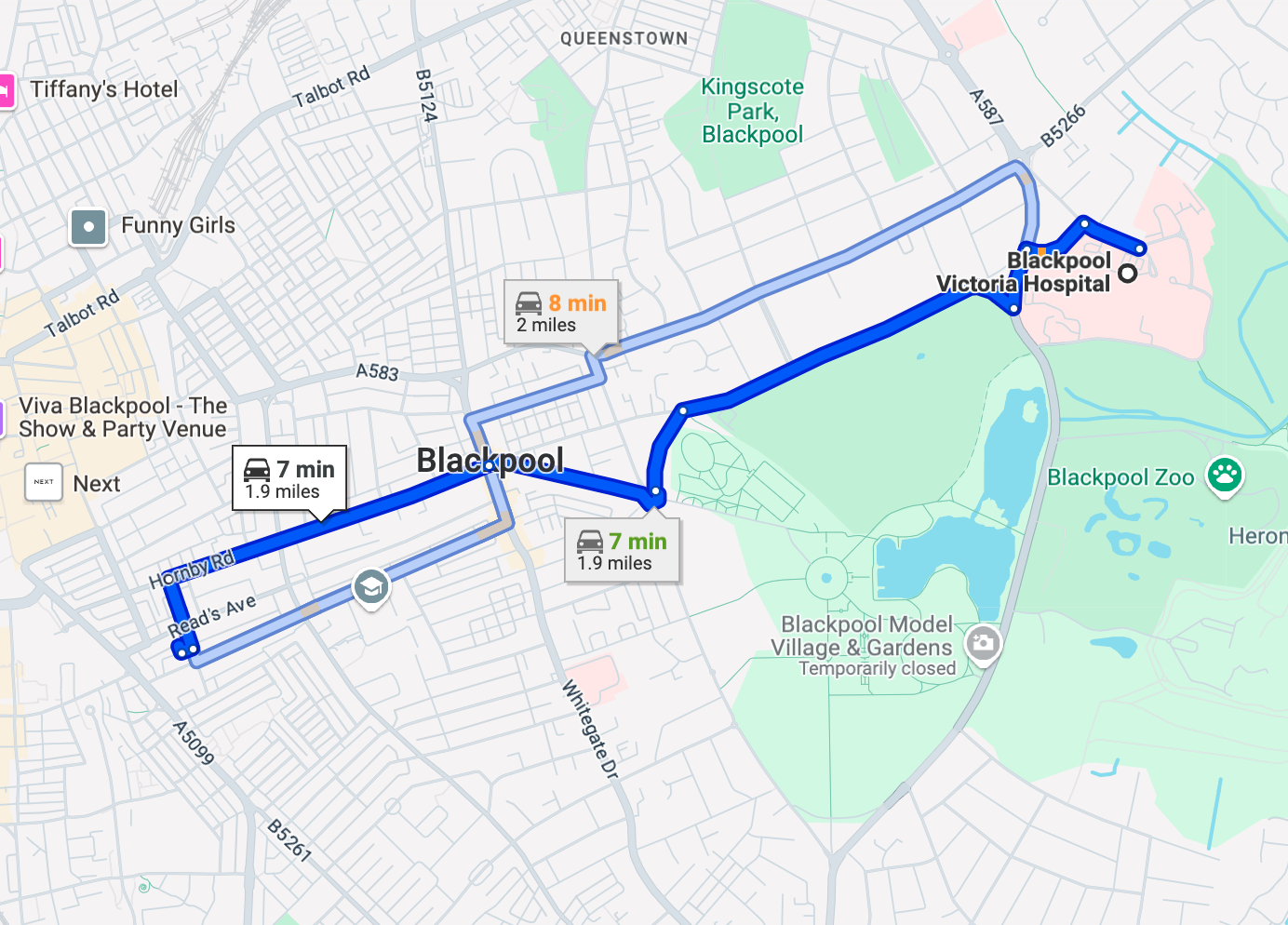

The property is within proximity to:

- 0.6 miles – Tower Train Station

- 0.3 miles – Blackpool and the Fylde College University Centre

- 1.9 miles – Blackpool Victoria Hospital

- 1.8 miles – Blackpool Pleasure Beach

- 2.1 miles – Blackpool Zoo

- 1.0 miles – Blackpool North

- 0.6 miles – Blackpool City Centre

Rental

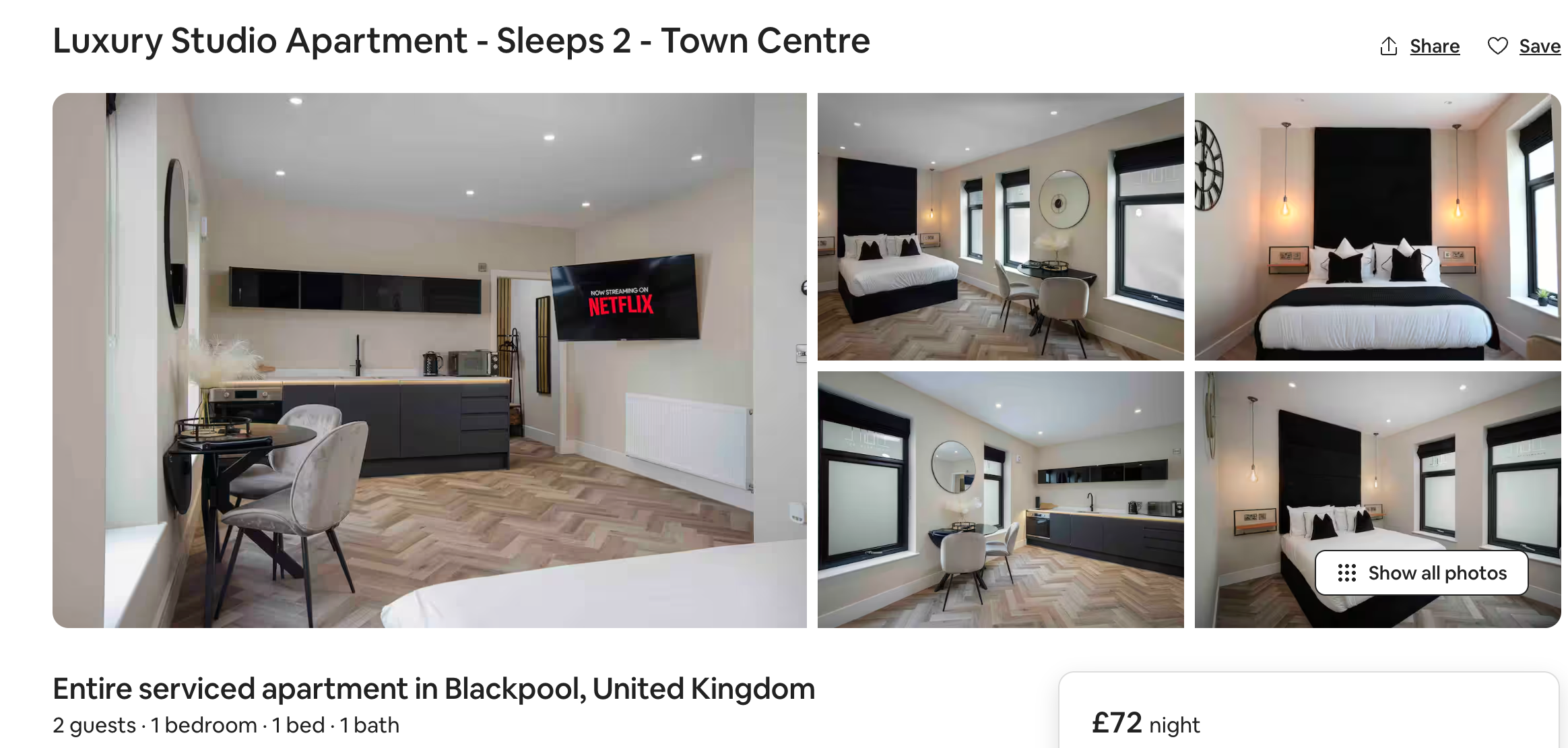

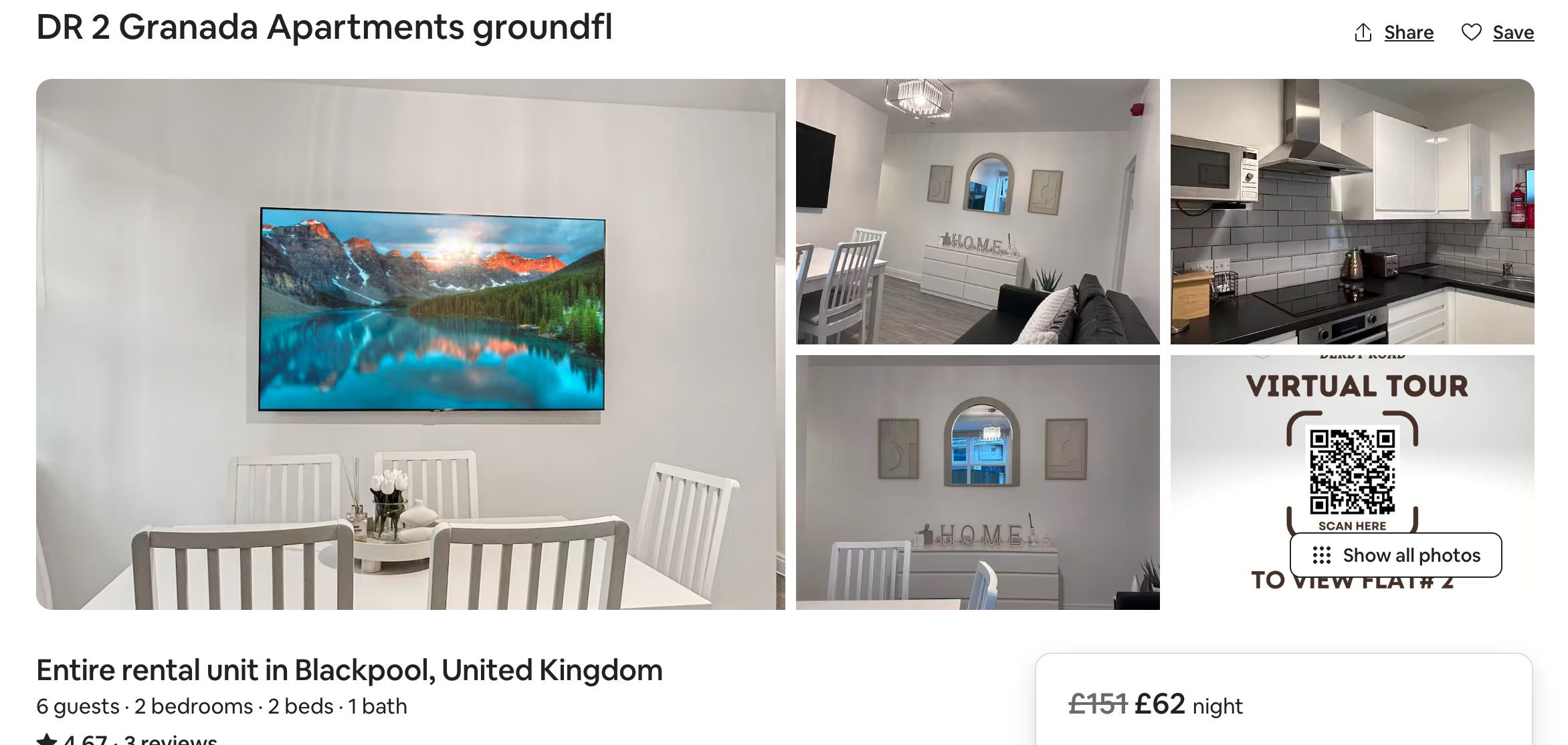

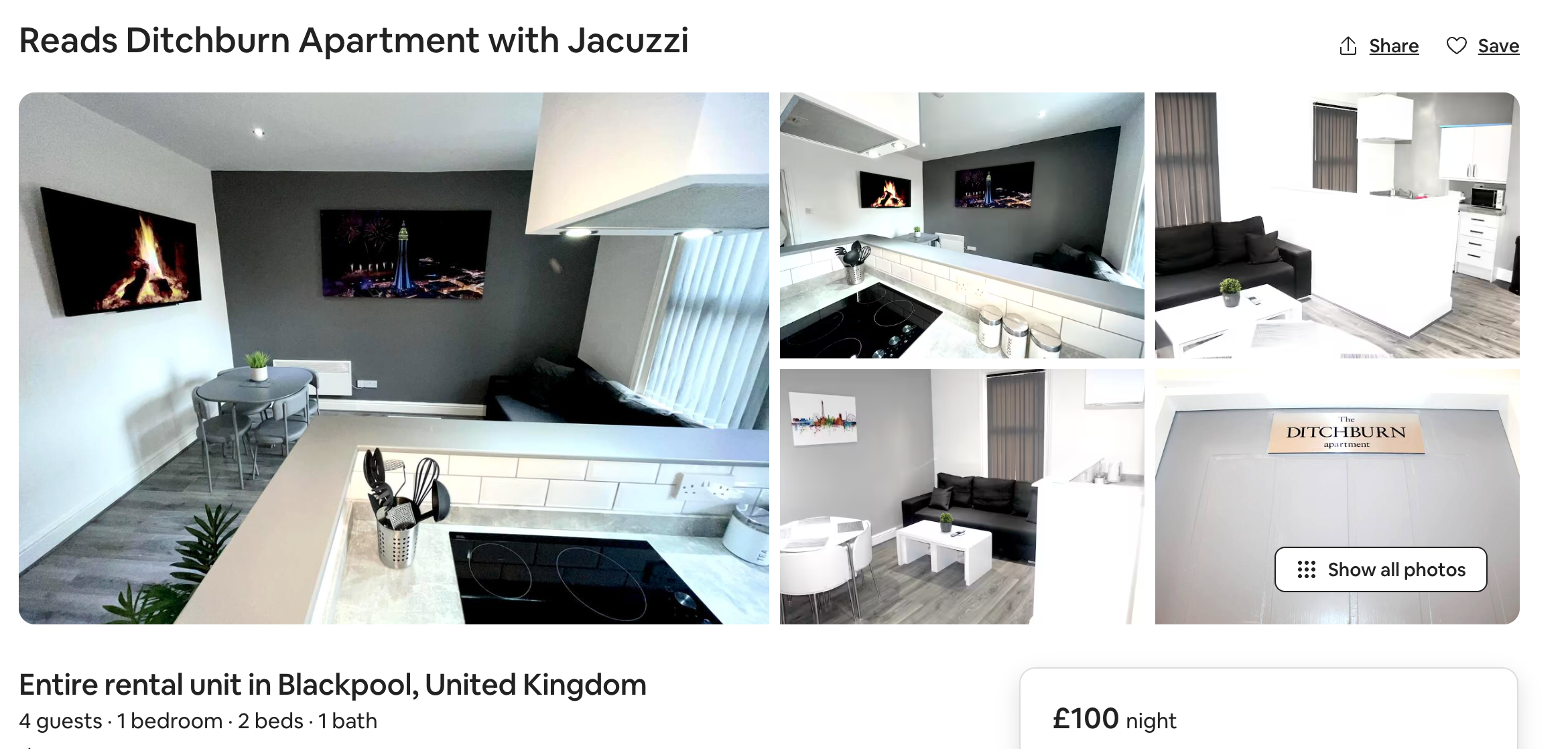

As Serviced Accommodation

Each unit could be rented for an average of £75 per night.

- Based on 20% Occupancy = £1,824 pcm = £21,888 per annum

- Based on 30% Occupancy = £2,736 pcm = £32,832 per annum

- Based on 40% Occupancy = £3,648 pcm = £43,776 per annum

- Based on 50% Occupancy = £4,560 pcm = £54,720 per annum

- Based on 60% Occupancy = £5,472 pcm = £65,664 per annum

- Based on 70% Occupancy = £6,383 pcm = £76,596 per annum

- Based on 80% Occupancy = £7,296 pcm = £87,552 per annum

- Based on 90% Occupancy = £8,208 pcm = £98,496 per annum

- Based on 100% Occupancy = £9,120 pcm = £109,440 per annum

Potential Gross Income Based on 70% Occupancy = £6,384 pcm = £76,608 per annum

As Standard Single Let

- Flat 1 - Currently rented for £695 per month

- Flat 2 - Could be rented for £550 per month

- Flat 3 - Could be rented for £550 per month

- Flat 4 - Could be rented for £600 per month

Potential Gross Income = £2,395 pcm = £28,740 per annum

The Vision

- To purchase the property for £150,000 and enjoy great cashflow

- Potential to refinance based on a commercial valuation allowing you to pull out a large majority of your initial capital.

- Potential to use the property as serviced accommodation to generate high cashflow.

Cashflow Forecast

- Potential Rental Income (Serviced Accommodation) = £6,384 pcm = £76,608 per annum

- Potential Rental Income (Single Let) = £2,395 pcm = £28,740 per annum

Cost To Consider

Serviced Accommodation

- Mortgage Cost = £469 pcm

- Bills and Utilities = £400 pcm

- Management @ 15% + Vat = £1,149 pcm

CASHFLOW AFTER ALL THE ABOVE COSTS

Managed = £4,366 pcm = £52,392 per annum

Self Managed = £5,515 pcm = £66,180 per annum

As Single Let

- Mortgage Cost = £469 pcm

- Management @ 15% + Vat = £287 pcm

CASHFLOW AFTER ALL THE ABOVE COSTS

Managed = £1,639 pcm = £19,668 per annum

Self Managed = £1,926 pcm = £23,112 per annum

Capital Required To Get Involved

- Purchase Price = £150,000

- Deposit @ 25% = £37,500

- Legals = £1,500

- Stamp Duty = £0

- Finder’s Fee = £8,700

Total Capital Required = £46,200

The Return On Investment based on an investment of £46,200

Serviced Accommodation

Managed = 110%

Self Managed = 139%

Single Let

Managed = 43%

Self Managed = 50%

We are in contact with a local letting agency within this location who would be able to manage the property.

Next Steps

- Reserve

- View

- Proceed

Disclaimer - IMPORTANT NOTE TO PURCHASERS:

Investment

£150,000

Purchase Price

£5,196

Potential Cashflow PCM

139%

Return On Investment

£8,700

Finders Fee